Will 3D-Printed Steaks Be A Real Business?

Most stories about cultured meat or vegetable-based meat substitutes emphasize the profound environmental and health benefits. Those benefits are vital and true, but I want to focus on whether lab-made meat can compete as a business.

The Future Is Lab-To-Plate

The vast majority of global consumers do not have the disposable income to fork over a premium for ecologically friendly fare. For lab-meat to displace animal-grown protein it has to win on price and taste. I believe that on those core purchase points the lab-made products will crush meat grown on animals. They will enjoy sustainable advantages in cost, variety, and pace of innovation. The future meat industry will be lab-to-plate.

Whether Lab Or Animal, It’s Just Manufacturing

Growing livestock is just a manufacturing business. It has inputs, outputs, and waste. A meat producer’s goal is to maximize the output value for every input while ensuring that waste is minimized and well managed. Like any business, the critical questions are what the customers want and how much they are willing to pay. Beef Magazine surveyed US Millennials in 2016 on their meat purchase criteria. Of any group that would prioritize green/organic metrics, they’re it. The result: “Price per pound, along with total package price, dominates the purchase decision tree. Product appearance fell back to third place.” The fundamental question for meat producers is, “How do we create large quantities of good tasting, decent-looking meat at the lowest-possible cost?” The fight is on: gargantuan feed lots jam-packed with animals versus sanitary labs equipped with bio-reactors and 3D printers.

Complementary Lab-Meat Technologies

Two technologies compete against traditional meat. Plant-based meat substitutes use, well, plant materials. Alternatively, “cultured meat” is DNA-identical animal tissue grown from living animal cells. The “Impossible Burger” from Impossible Foods is soy-based. It also contains heme, an iron-rich molecule that helps proteins carry oxygen in living organisms. Heme gives beef its reddish color and contributes to its meaty aroma and flavor. Impossible Foods makes its heme with genetically modified yeast. Beyond Meat’s popular burger is made from peas, mung beans, and rice. It is infused with beetroot for a reddish hue to “bleed” when bitten into. It also contains bits of coconut oil and cocoa butter that give the burger a marbling, like the fat in beef Cultured meat is crafted by companies like Berkeley’s Memphis Meats and Israel’s Aleph Farms, Future Meat, and SuperMeat. Their processes grow animal cells in large reactors, sanitary metal cylinders like what you might see in a brewery or winery. Think of making yogurt, but a lot more sophisticated. These two technologies, plant-based and cultured, may well turn out to be complementary. Leading food companies already have highly successful meat-plant blends on the grocery shelves.

Why Are There So Many Cultured Meat Start-Ups In Israel?

Israel’s combination of technical know-how and market demand is conducive to growing a cultured meat start-up ecosystem. There is highly active stem-cell and tissue-culture research producing a community of scientists and engineers who are well-trained in the needed foundational skills. A 2015 study found that five percent of Israelis identified as vegan and eight percent as vegetarian, while 13 percent were weighing going vegan or vegetarian. Israel, which hosted the 2017 Vegan Congress, has the highest percentage of vegans per-capita in the world.

Lower Cost: It’s Only A Matter Of Time

The very first cultured beef burger debuted in London in 2013. It cost $320K, and the research needed funding from a billionaire, Sergey Brin. The burger looked like beef, cooked like beef, smelled like beef, and felt and tasted like beef on food critics’ palates. That’s because it was, in fact, beef. The only complaint was that it was too lean; we all know that “fat means flavor.” Plant fats like coconut oil and cocoa butter are used today successfully while research continues toward a commercially-scalable process to culture animal fat. As is the typical pattern with new technology, cultured beef cost is plummeting:

If the cost keeps dropping at the current rate of 50% per year, cultured beef will match animal-grown beef in price in just four years.

Flavor And Appearance

Food Network, the home of culinary stars like Bobby Flay and Giada De Laurentiis, named Perdue Farms Chicken Plus the best-tasting chicken nuggets on the market in 2020. The product is only 75% chicken meat: the rest comes from plant material from Better Meat Company. Beyond meat has deals with McDonald’s, Pepsico, and Yum (KFC, Pizza Hut, and Taco Bell). Burger King, White Castle, and others sell Impossible Burgers. The holy grail of manufactured meat is a thick, juicy, flavorful steak (My favorite is a T-bone, medium-rare). Only eight years after the first manufactured hamburger, consumers may be buying 100% cultured-beef steaks in 2021. Both Aleph Farms and Redefine Meat converge cellular engineering with 3D printing to create products mimicking the shape and texture of full cuts of beef. Aleph is targeting Japan, one of the world’s most discriminating food markets in a major alliance with Mitsubishi. After enthusiastic feedback in taste tests, Redefine Meat will distribute its products to restaurants and butchers in Israel. Detractors argue that Perdue’s product is only 25% non-animal-grown and that Aleph and Redefine’s fare is not commercially proven. However, while animal husbandry has been refined for thousands of years cultured meat is just approaching its eighth birthday

Exponential Meat’s Rapid Evolution

Cattle really can’t be made to taste any better or grow much faster. Their lab-grown competition can improve daily. Future Meat’s production time is down to 2 weeks. Cattle take 9 months to gestate and 18 months at a minimum to reach slaughter maturity. Thus in the time it takes to create and slaughter one new cow, Future Meat and multiple other competitors can refine 60 generations of product for cost, flavor, texture, appearance, and nutrition. Unlike cattle, that production time will go down with further technology growth. Animal meat producers have only one lever to play with: production efficiency (cost). That cost-reduction drive is realized through massive feedlots, antibiotics, and feed blends that the animals would never consume in the wild. The new meat makers can nimbly design and adapt their products to optimize cost and many additional benefits. In less than a decade, they have progressed from entirely lean to fatty and juicy. From hand-crafting one at a time to pilot-line manufacturing with industrial equipment. It really isn’t a fair fight.

Critics Don’t Recognize Fast Technical Evolution.

I hear objections to manufactured meat. “We’re omnivores. Lab meat will never have all the nutrients that we need.” And, “There’s no way that the texture of meat can be recreated. It is too complex, too intricate.” Here is the pattern that I’ve witnessed for decades in technology development: constant iteration with rapidly advancing technologies wins. As long as there is strong potential for a less-expensive, good-tasting manufactured-meat product, investment will keep flowing to break through the barriers.

Multiple Startups And Big Corporate Partners

Accelerating investment is yet another advantage for non-animal meat. Startup funding in cultured meat alone grew from $109M in 2018 to $444M in 2020. Just last month, Redefine Meat announced a new $36M round. Money isn’t only coming from venture capitalists: serious corporate cash is going to work. Aleph Farms’ investors include Mitsubishi and global food giant Cargill. Tyson is one of the world’s five largest food companies and a massive producer of animal-grown meat. Yet, they have invested in Future Meat, Beyond Meat, and Memphis Meat. Tyson’s CEO, Tom Hayes, famously told Bloomberg in 2016, “If we can grow meat without an animal, why wouldn’t we?”

Future Livestock

There actually will be animal-grown meat in the future. Livestock can eat range grasses growing for free on land that’s no good for farming. Grazing even has ecological benefits when it is well-managed. The animals won’t grow as fast, large, or numerous as today’s factory feedlot beasts. Grown in much lower volume than today, they will be a viable source of good-tasting protein for those with land to graze and consumers willing to pay a higher price for a product with limited supply. This most traditional production method can only happen where there is suitable land, climate, and water. Lab-grown meat will be manufactured wherever in the world there are people ready to eat it.

New Technologies, Same Old Pattern

Animal-grown versus manufactured meat is just another competition of old methods versus new technologies. In one corner is the traditional industry: raising and slaughtering animals. In the other corner is a bio lab with exponential trappings: a convergence of computing, synthetic biology, and materials science with rapid iteration and multiplying investments. This industrial battle is no different than vacuum tubes vs. silicon, celluloid film vs. digital cameras, petrol vs. electric motors, and coal vs. wind and solar power. The new paradigm delivers superior benefits at a much lower cost. If you’re running a business, you need to plan your transition to the new paradigm whenever you see this pattern. And yes, the potential environmental and health benefits of the new meat are astounding. In the next protein production paradigm lab-made meat producers will offer those benefits and turn a good profit. How cool is that?

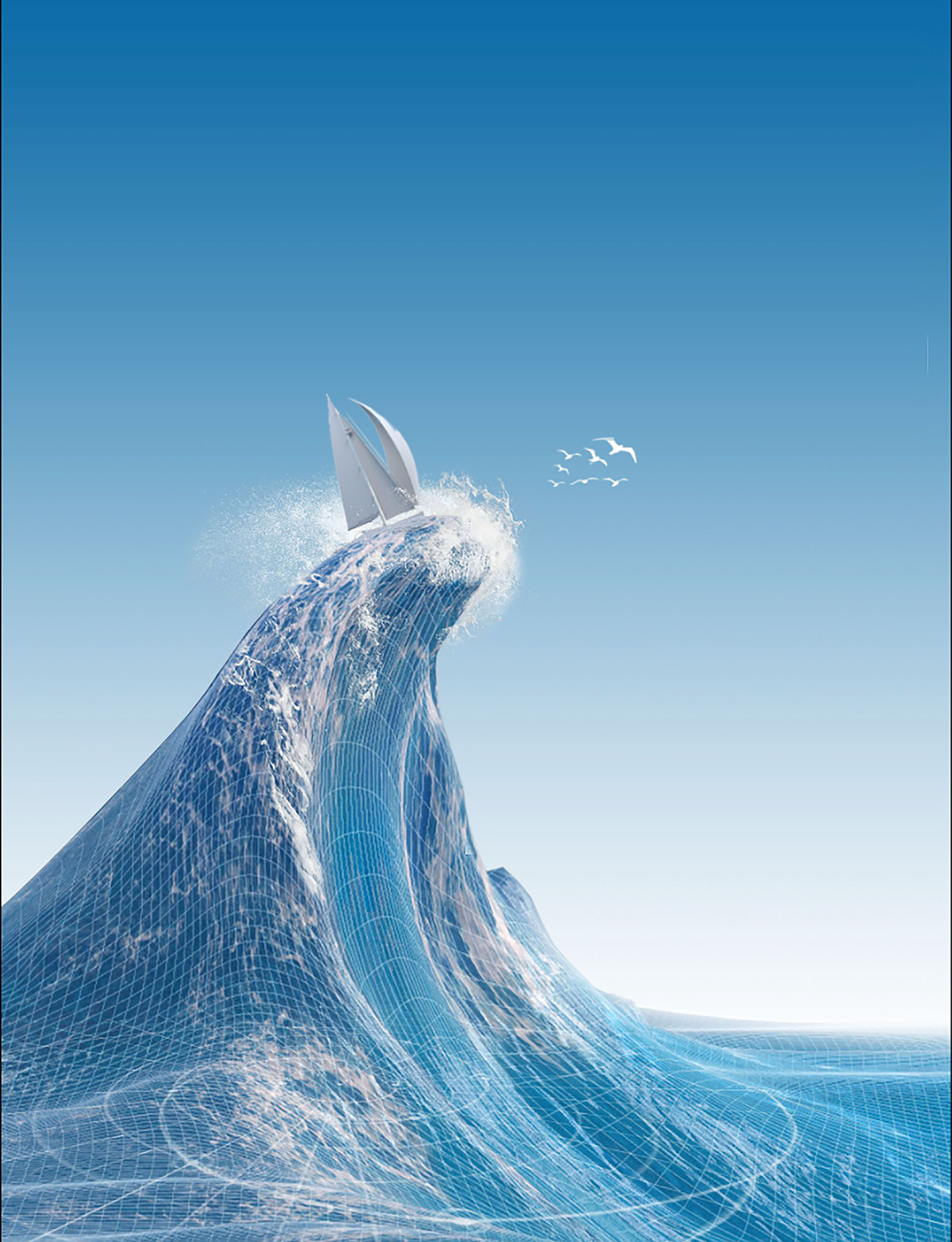

Cover Photo

Images from Redefine Meat